|

The Hanley and Hoberg emerging risks database is based on a major

computational linguistics project that was funded by NSF Grant #1449578. The project also benefitted from text

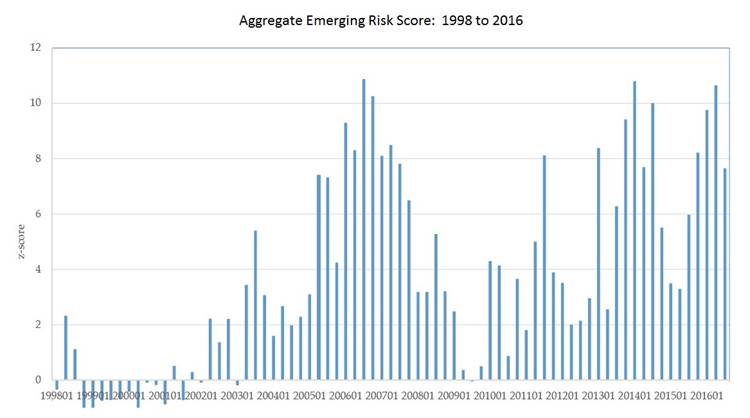

analytic tools and expertise provided by metaHeuristica LLC. Research Abstract We use computational

linguistics to develop a dynamic, interpretable methodology that can detect

emerging risks in the financial sector. Our model can predict heightened risk

exposures as early as mid-2005, well in advance of the 2008 financial crisis.

Risks related to real estate, prepayment, and commercial paper are elevated.

Individual bank exposure strongly predicts returns, bank failure and return

volatility. We also document a rise in market instability since 2014 related

to sources of funding and mergers and acquisitions. Overall, our model

predicts the build-up of emerging risk in the financial system and

bank-specific exposures in a timely fashion. [Download Complete Research

Paper] Brief Summary of Methods The emerging risks database

is based on risk factor disclosures parsed from bank 10-Ks, which are then

processed using two text analytic tools in tandem. The text-based risk factor data is based

solely on 10-K risk factor disclosures made by publicly-traded US Banks. This

data is extracted from 10-ks using metaHeuristica’s

high-speed database to precisely extract annually updated risk factor

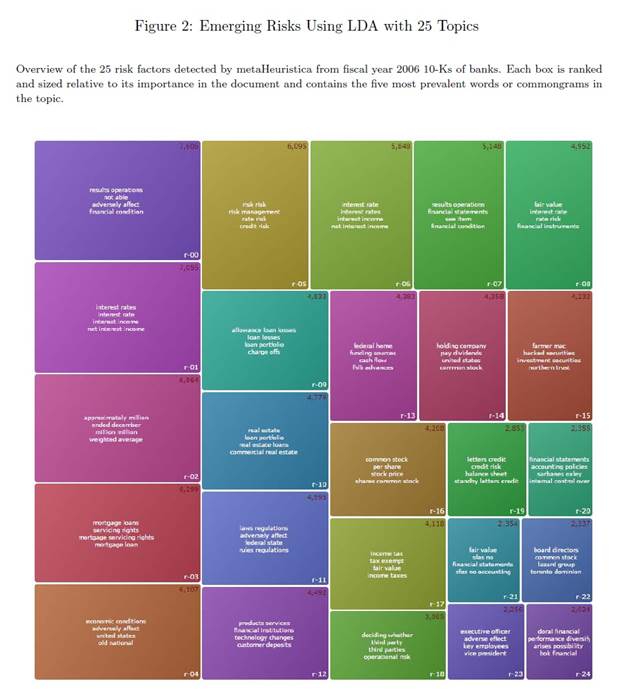

disclosures for each bank from 1997 to present. Separately for each year, we then run metaHeuristica’s integrated topic modeling module to

obtain a 25-factor Latent Dirichlet Allocation

(LDA) model, which we use to extract 625 bigrams (top 25 from each risk

factor). Because LDA puts high probability weights on bigrams that are

present in the risks disclosed by many banks, these 625 bigrams are systemically

important and not idiosyncratic.

Finally, the bigrams are fed into metaHeuristica’s

semantic vector technology, which uses a neural network to generate a vector

space model. This final step extracts

interpretable vocabularies that define each economically meaningful

bigram. We then score each bank to

determine its final risk exposures using simple cosine similarities. Please see the research paper referenced on

the right for all methodological details (above is a very brief summary

only). We use these methods to

construct two emerging risk models.

The first is a static risk model, where the candidate risks are

selected based on the existing literature on fundamental risks. In this model, the risks are held fixed

during the entire sample. The second

is an automated dynamic model where the 625 unique bigrams extracted above

are filtered down to a set that is free from multicollinearity, economically

relevant, and economically interpretable.

In this model, the number and the list of risk factors varies from

year to year.

Hanley

and Hoberg Data Library

|

|